In the world of finance and accounting, the concept of the so-called “virtual close” has been around for almost 20 years. In fact, I did some research and published a white paper on this topic back in 2002. At the time, there were several companies such as Cisco Systems and Motorola that had adopted the technique. At that time, the definition of the virtual close was the ability for a company to close its books at any time, within a few hours’ notice, and for management to have real-time insight into the state of the business.

As a result of the COVID-19 pandemic in 2020, the definition of the virtual close has evolved, now highlighting the ability for remote workers to effectively close the books and produce financial and management reports within their normal closing schedule. That’s a related but different topic, so for the sake of this article, let’s stick with the original definition.

The impetus for implementing the “virtual close” was to shortcut the usual month-end or quarter-end close and reporting cycle which, at the time, took 12 days on average and delayed the delivery of financial results. The idea of the virtual close was that an organization could produce consolidated financial results at any time of the month – literally within a few hours.

But is this really feasible and are consolidated financial statements really required to support day to day decision making? Not really.

The Virtual Close Panacea

My research back in 2002 revealed that organizations who had achieved the panacea of the “virtual close” did so only after making major changes to their financial processes, management culture, and financial systems, and over a long period of time. In fact, the organizations that were supposedly performing the virtual close really had the close down to about 2 days at month-end. To support management decisions on an interim basis they were collecting key operating metrics and delivering those to management on a daily and weekly basis.

Fast forward to 2020, and very few organizations have yet to achieve the original concept of the virtual close, although there is more buzz these days about the “continuous close,” which is a related concept.

Whatever you call it, the concept of closing the books continually, or even in a few hours at any time is still an impractical panacea. Why? Well think about it – how often does your organization run payroll? Once or twice per month – right?

In order to close the books daily, or at any given point in time would require extensive accruals of payroll costs, as well as building and equipment leases, utilities, travel and other expenses.

Then there’s the challenge of collecting and consolidating financial results from multiple GL/ERP systems. According to a recent market surveys, only 20% of organizations have a single, central GL/ERP system. Achieving the virtual close could be possible with a single GL/ERP, but most organizations have multiple systems from which they must collect and consolidate financial results in order to close the corporate books.

What about account reconciliations? This is a critical part of the financial close and a key control for most organizations. Larger enterprises often have hundreds to thousands of accounts that must be reconciled at period-end in order to produce accurate financial results. Are we going to require accounting and finance teams to reconcile their accounts every day in order to achieve the virtual close?

What about the Continuous Close?

Don’t get me wrong. There’s nothing wrong with performing transaction matching or account reconciliations on a regular basis to save time on the month-end close cycle. That’s really the essence of today’s “continuous close.” It’s about getting ahead of some of the tedious tasks that hold up the month-end or quarter-end close.

But the virtual close is still not achievable by most organizations. And it’s not really even required to support informed decision-making. For example, do CFOs and other executives really need a complete set of financial statements to “lead at speed” and make informed decisions on a day to day basis? Not really.

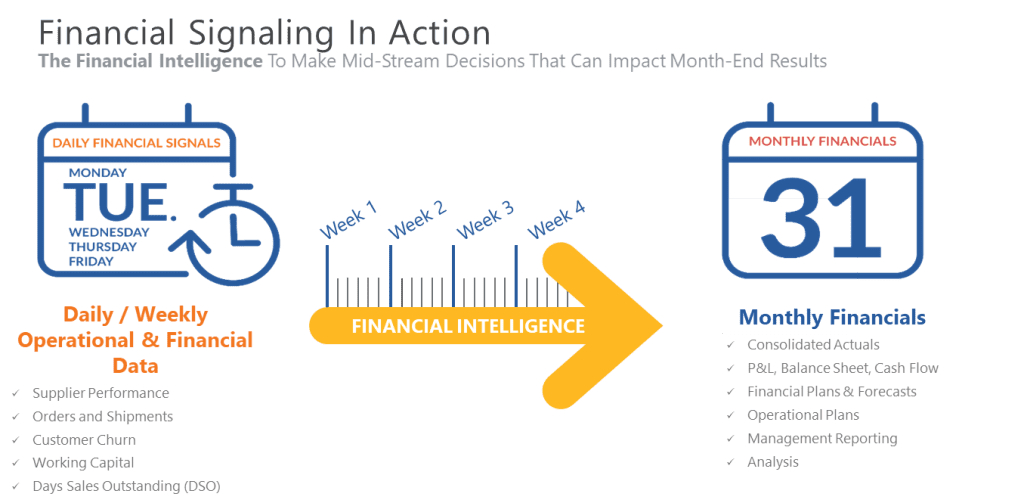

A more realistic and useful approach is to identify and collect key metrics or KPIs that really drive the business and use that information to drive tactical decision on a daily or weekly basis. This is basically what Cisco and Motorola were doing 20 years ago.

We now call this process – “Financial Signaling.”

Financial Signaling Augments the Period-End Close

Most organizations arm their management teams with monthly and quarterly financial statements, management briefing books and interactive dashboards that include summaries of sales, costs of sales, operating expenses, profitability by product, geography and customer groups and other useful information. But there’s also a treasure trove of valuable information that’s collected every day in ERP, CRM, HCM, Supply Chain and other systems that are typically not leveraged to support daily and weekly operating decisions. Here are some examples:

- Supplier costs, delivery and quality

- Customer orders and shipments

- Sales pipeline

- Customer renewals

- Working capital

- Billings and collections/DSO

Organizations are increasingly interested in harnessing these large volumes of operational and often transactional data to identify key trends and “signals” that can support daily and weekly decisions that can positively impact month-end financial results.

Financial Signaling with OneStream

The good news is that the process of Financial Signaling is now possible using OneStream’s Intelligent Finance Platform. OneStream supports financial close and consolidation, planning, budgeting, & forecasting, financial data quality, as well as reporting & analytics all in one unified platform. Then OneStream takes performance reporting to the next level with support for Financial Signaling.

OneStream’s new Analytic Blend capabilities enable customers to blend governed financial information with detailed operational data in the same platform and present this information to users in the same dashboards and visualizations. This enables users to develop deeper insights and understanding of historic results from prior periods – as well as daily and weekly updates of financial and operating results for the current period. It’s within these daily and weekly views of the business that managers can identify key operational trends and financial signals that can turn into immediately actionable insights.

The ability of the finance team to blend financial and operational data enables executives and managers to gain “right-time” insights to the right data and quickly answer detailed questions about the current state of the business. It also provides the foresight needed to take corrective action “mid-stream” that can impact current and future financial results, rather than waiting until after period-end, when it’s too late to make an impact.

Learn More

So if your organization is closing the monthly books in five days or less – that’s great, in fact it’s considered “world class” by most definitions. You don’t need to achieve a 1-day or “virtual close” to lead at speed and make informed decisions on a daily and weekly basis. A growing number of OneStream customers are taking advantage of our platform to support Financial Signaling, as well as daily and weekly forecasting and modeling of revenue and cash flow to support “right time” decision making in this time of economic uncertainty. To learn more, download our white paper titled Finance in the 2020’s: Leading at Speed.

John O’Rourke | Dec 28, 2020

This article originally appeared on the OneStream blog. Used with permission.