Managing and completing account reconciliations in a large global enterprise can be daunting due to the number of data sources and the volume of reconciliations that need to be completed. Reliance on spreadsheets or other disconnected solutions can result in errors and delays in completing critical account reconciliations and can extend the financial close process.

Remedying these challenges is one of the key missions of OneStream Software and was the topic of a recent webinar titled “Aligning Account Reconciliations with Financial Reporting.” The event featured an overview and live demonstration of the Account Reconciliations software that’s available from the OneStream XF MarketPlace. You can watch the webinar replay here, and below is a quick synopsis of the discussion.

Modernizing Finance with OneStream and the XF MarketPlace

I kicked off the webinar with a brief overview of the OneStream XF platform and our XF MarketPlace solutions. In case you aren’t familiar, OneStream provides a unified SmartCPMTM platform that simplifies and aligns key Finance processes – financial consolidation, reporting, planning, analysis and data quality. We call this SmartCPM because we are drawing the analogy to the Smart Phone. On day one, just like you can make a call, send an email or text, on your iPhone – with our modern platform you have a lot of pre-built functionality out of the box, but you can also extend it. Back to that in a minute.

With OneStream, customers can replace multiple legacy applications with a modern, scalable platform, that runs on-premise or in the cloud. We simplify life for Finance admins and users and enable them to spend less time managing systems and moving data – and more time on analysis and focusing on the business. That’s why our tagline is “get back to business!”

Back to the “extend” part. What’s really powerful about OneStream is that customers can extend their investment with our XF MarketPlace solutions. The XF MarketPlace provides over 50 additional solutions customers can download into the platform – without the added complexity and extra costs that have plagued previous generations of CPM products. We are the only CPM vendor that has been able to deliver on the AppStore concept – and our customers absolutely love it!

Why? Because our XF MarketPlace is designed to work like the Smart Phone. That means you can add a solution without having to do an upgrade. Just download it, and its incorporated into the platform and inherently unified with your core processes; no additional products to buy or integration to maintain. You just download, configure and deploy to your users.

This not only makes it easier for you to extend the value of the platform, it also allows us to deliver new capabilities faster. And the XF MarketPlace solutions, like Account Reconciliations, can be updated regularly and made available quickly – we don’t have to wait for the next release of the platform.

OneStream Account Reconciliations

Account Reconciliations is one of our most popular XF MarketPlace solutions. To date, we have over 80 customers who have downloaded it, and many have now deployed it – often replacing Excel spreadsheets and point solutions such as Blackline and Trintech. Our customer AFL, who replaced Blackline with our Account Recons solution, says our approach has sped up their account recons process by 75%, and saved them about $100K per year in software licenses. Not bad eh?

So, what’s the secret? That’s where my colleague and “rock star” of account reconciliations Kelly Darren comes in. During the webinar she provided an overview of the financial close process and the important role account reconciliations play in the close to ensure the accuracy and integrity of the financial statements.

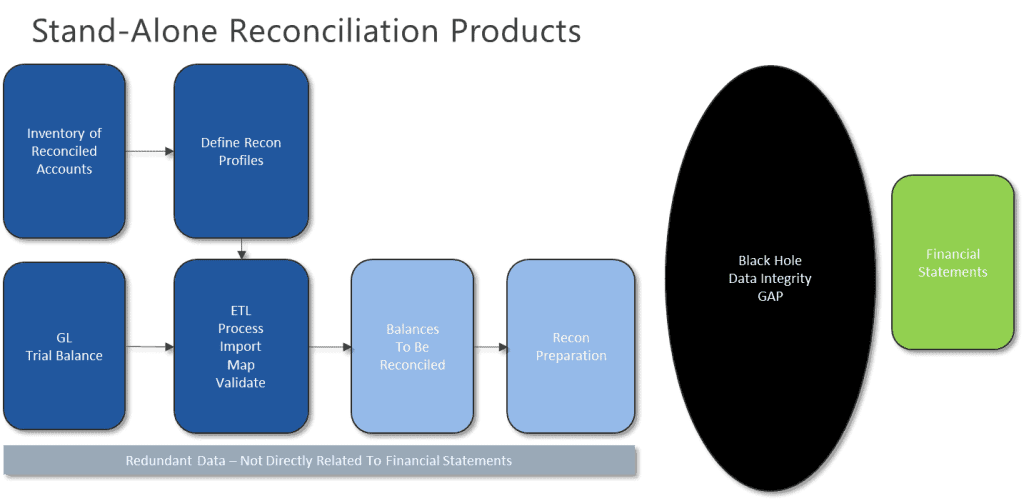

Then she highlighted how the process works in organizations that rely on standalone account reconciliation products – with a huge “black hole” existing between the account recons and the financial statements. When account recons are happening in a separate system from the financial reporting process – data can easily get out of synch – causing delays in the close process and data integrity issues.

With OneStream it’s a much different picture. Because GL trial balances are loaded into a single system for both financial consolidation, reporting and account recons – the data is always in synch and the close process is faster and more efficient. And users can easily drill from the financial statements, right into the account recons.

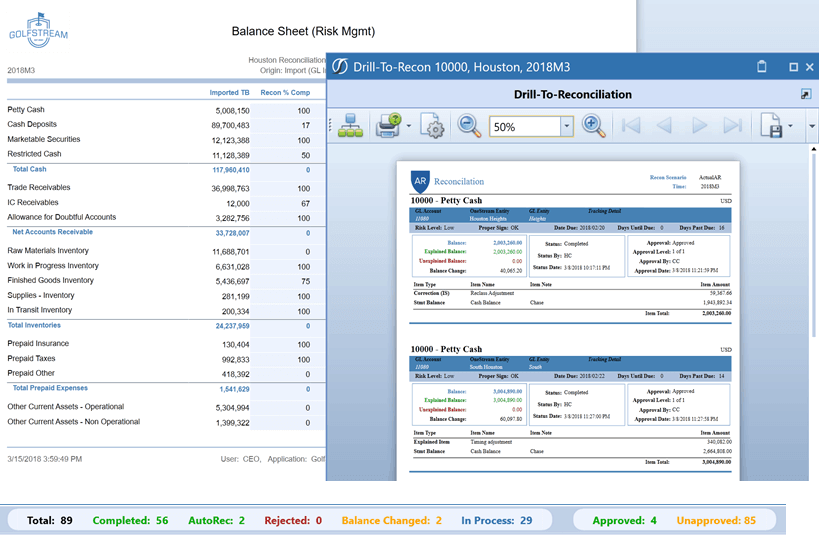

Kelly then went on to provide a live demonstration of the solution, highlighting how users are guided through the financial close and tasks such as account recons. She also highlighted how trial balances and transactional details are loaded into OneStream, and how account recons are performed, approved, signed off and ultimately reported.

Learn More

To learn more about the power of aligning account reconciliations and financial reporting with OneStream, watch the replay of the webinar and feel free to contact OneStream if you need to pull your organization out of the “black hole” of account reconciliations.

John O’Rourke | Apr 03, 2019

This article originally appeared on the OneStream blog. Used with permission.